The Debt Service Coverage Ratio (DSCR) is a financial metric used to measure a borrower’s ability to repay a loan based on the income generated by a property or business. It is commonly used in commercial real estate, including investment properties and DSCR loans for real estate investors.

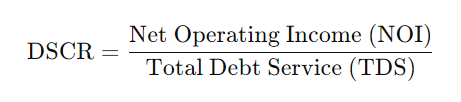

DSCR Formula:

- Net Operating Income (NOI): The annual income generated by the property after operating expenses have been deducted, but before mortgage payments (debt service).

- Total Debt Service (TDS): The annual debt obligations of the borrower, including principal and interest payments on the mortgage(s).

Steps to Calculate DSCR:

- Determine the Property’s Net Operating Income (NOI):

- Gross Rental Income includes all income generated by the property (e.g., rent, fees).

- Operating Expenses include costs such as property management fees, maintenance, property taxes, insurance, utilities, etc. (Excludes mortgage payments).

- Calculate the Total Debt Service (TDS):

Add up the annual principal and interest payments on all loans associated with the property (including first mortgage and any secondary loans). - Calculate DSCR:

- If DSCR is greater than 1: The property generates more income than needed to cover debt obligations, which is favorable.

- If DSCR is less than 1: The property’s income is not enough to cover its debt obligations, indicating a negative cash flow situation.

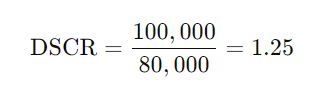

Example Calculation:

Let’s say:

- NOI (Net Operating Income) = $100,000

- TDS (Total Debt Service) = $80,000 (annual mortgage payments)

A DSCR of 1.25 means the property generates 25% more income than is required to cover its debt obligations.

Key Takeaways:

- A DSCR of 1 means the property’s income is just enough to cover debt payments.

- A DSCR above 1 indicates good financial health, as income exceeds debt obligations.

- A DSCR below 1 suggests potential cash flow issues and increased risk for lenders.

In real estate investing, a DSCR of 1.2 to 1.5 is often considered strong, though specific requirements can vary depending on the lender.